Some NBA teams don’t worry about balancing the books. Their owners swim in deep green seas of personal wealth. They treat league membership as an extension of their entitlement, a bragging right with benefits of ballooning equity.

The Kings are different. Their owners are rich, relatively speaking, but can’t matchup against billionaires. A welterweight bank account is a big disadvantage in a game played by heavyweights.

NBA players and their agents recognize the Kings’ financial anxiety. Nobody wants to waste time and talent on a tourist-class franchise. The Kings are tourist class: no legroom, extra fees for a sandwich and baggage, best to avoid.

The welterweight bank account almost sank the Kings under the pandemic. While NBA teams are guaranteed to grow in value, they demand significant cash flow to keep the doors open. Suddenly, the Kings had zero cash flow and serious problems.

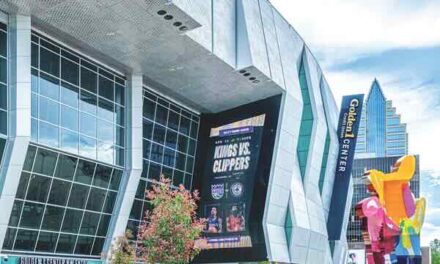

To compensate for canceled games, the NBA and players union allowed teams to withhold about 25 percent of salaries. The Kings went further. They laid off staff and used a loophole in their city lease agreement to skip payments on Golden 1 Center. They rented out old Arco Arena as an emergency COVID hospital. They tapped an internal NBA charity fund to help struggling teams survive financial convulsions.

The NBA is sympathetic toward poorer owners, but generosity has limits. Financially soft ownerships eventually have to go. Many have been pushed out as the game became more expensive.

Historically, the Kings have languished among the league’s low-budget operations. Fiscal distress clouded the Cincinnati and Kansas City eras. After moving to Sacramento in 1985, the team sweated to pay bills. Players sprinted to the bank to cash paychecks, fearing the paper would bounce. Vendors were stiffed, team credit cards canceled.

Today, things are different—not because managing partner Vivek Ranadive swims in money (by NBA standards, he just wades), but thanks to new investment rules to accommodate financially weak teams.

The new rules allow private equity groups to buy into NBA clubs. The embrace of private equity is a big policy shift for pro sports. It means teams don’t have to constantly tap their stockholders when stars demand pay raises. Capital calls can wreck small-time owners and their partners, especially the Kings.

Until recently, private equity money was barred from the NBA. The league’s stockholder model relied on car dealers, real estate guys and eventually tech moguls—the local business community.

The Kings are a good example of the old ways. Unable to purchase the team on his own, Ranadive corralled Bay Area fitness club operator Mark Mastrov and a bunch of buddies in 2013. He sold stock to several local businessmen, including Mark Friedman and Kevin Nagle. The group bought the Kings and quickly expanded into Downtown real estate, which helped reduce the pain of a loss-making basketball team.

Eight years and one pandemic later, with no end to the ruinous cost of running the Kings, Ranadive turned to private equity. The timing was perfect. Major League Baseball was first to welcome passive professional investment in 2019. The NBA soon followed.

Last June, the San Antonio Spurs sold shares to equity investors. The Kings jumped in months later. Mastrov, Friedman, Andy Miller, Brad Jenkins and Shaquille O’Neal sold out to Arctos, a private equity firm that manages $3 billion in assets. Nagle dumped most of his Kings stock.

Can private equity dollars improve the Kings? Not likely. Arctos can’t get involved with basketball operations (unfortunately). But institutional investors don’t care about courtside seats. They care about profits, which arrive only when the team is sold. Until then, Arctos brings something more important than a playoff invitation: cash.

R.E. Graswich can be reached at regraswich@icloud.com. Follow us on Facebook, Twitter and Instagram: @insidesacramento.