No Free Money

Mayor’s scheme could make city insolvent

By Jeff Harris

June 2019

Last year, when the Sacramento City Council voted to put Measure U on the November ballot, I dissented. The reason was simple.

I knew the city needed additional funds to deliver the parks, roads, public safety and other services residents expect. I appreciated how the permanent 1-cent sales tax would generate about $95 million each year.

But I knew some of the money produced by Measure U would have to pay the city’s current bills and future obligations. To say otherwise—to keep voters in the dark about our commitments to CalPERS pensions—was disingenuous.

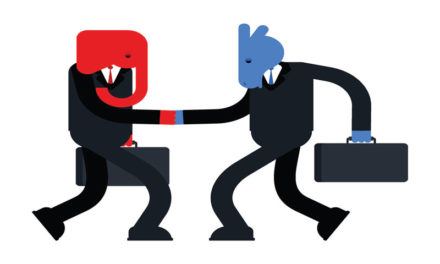

I offered a different set of options for Measure U, but the Council moved forward with Mayor Darrell Steinberg’s proposal.

I spoke out at public hearings. What I said was hardly revelatory. Anyone who paid attention to our city’s finances would have known the obvious: The original Measure U, a temporary half-cent sales tax passed in 2012, was insufficient to cover our CalPERS obligations, which escalate annually through 2025.

Now voters are learning the truth about Measure U. They are waking up to a different reality, finding that while Measure U was sold to voters as a wondrous tool for neighborhood youth services, equity, arts and jobs programs, it’s only partly that.

Despite what was promised in the campaign, some new Measure U dollars must be used to pay for core services and help cover the city’s pension obligations. But now Mayor Steinberg wants to turn Measure U into a bonding mechanism.

His plan to sell more than $400 million in bonds, and pay the debt service with Measure U revenue, will put our civic assets at risk and place taxpayers on the hook for 30 years for loans the city may not be able to repay.

The Measure U campaign promised salvation for neighborhoods. The new tax dollars would create investments and produce jobs and affordable housing and virtually everything anyone ever wanted. While the promises were tantalizing, they were misleading.

The extra half-cent does not generate enough revenue to realize all of the promises. But if we manage our budget well, we can achieve those goals in reasonable increments, without incurring massive debt.

The only promise made by the City Council to voters about Measure U was contained in the actual ballot language:

“Shall the measure to protect and enhance essential public safety services, including 9-1-1 response, fire protection, community neighborhood policing, and other essential services, including homeless supportive services, affordable housing, libraries, park maintenance, high-wage job promotion, and youth programming, by enacting a one-cent sales tax generating $95 million annually that is legally required to stay in the city’s general fund, until ended by voters, with independent annual financial audits and citizen oversight, be adopted?”

Those are the words the City Council agreed upon when we placed Measure U on the ballot. Nowhere in the ballot language was it suggested the tax would be the vehicle to incur massive new debt.

But the ballot language was a small part of what voters saw. They were bombarded with rhetoric on numerous glossy mailers—typical for a campaign sales job. Today, I’m afraid, it’s clear many voters were misled. Voters were promised a lot, but perhaps did not read the ballot carefully.

The new fiscal year finds Sacramento with $52 million in available cash to allocate to projects within the scope of the ballot language. That’s a good thing! We have not had this much available cash for many years, and we can fund great programs and projects with it.

But by law, the City Council must balance the budget. We balance it with general fund money. Once the bills are paid, we can make investments with any remaining dollars.

The city cannot issue bonds against a general tax measure. To sell bonds the way Mayor Steinberg suggests would require collateral—our real estate holdings such as parks and fire stations, and even the Convention Center, once it’s completed.

Should we issue bonds collateralized by real estate, essentially mortgaging the city for “Inclusive Economic Development?” I think not. This scheme would expose the city to insolvency at the slightest economic downturn.

The better path is to adopt the city manager’s proposed budget. It charts a sound course, with substantial investments that align with City Council goals. It does not issue new debt.

It’s great to dream big. But bonding unwisely can lead Sacramento to bankruptcy, as happened to Stockton. We must live within our means. We must balance our budget, meet our fiscal obligations and be reasonably conservative, since an economic downturn is always possible.

Homeowners should recognize the situation better than anyone. If you pull all the equity from your home and rely on that money to pay your mortgage, you are in a debt trap. You will likely lose your home.

The same rules apply to the city.

Jeff Harris is the Sacramento City Councilmember for District 3. He can be reached at jsharris@cityofsacramento.org.