Earlier this year, a sports business site called Sportico estimated the Kings’ total value at $1.84 billion. That amount covers everything, from the team and its sponsorship deals to real estate.

As someone who has followed the Kings and laughed along with their failure since the early 1980s, I thought of two questions: If I owned the team, would now be the right time to sell? And might some Kings owners wonder the same thing?

The answer, according to people who study such matters, is a definite maybe.

If you need cash and are tired of borrowing money and liquidating assets to support your team’s losses, then yes, you should sell. If you aren’t worried about cash flow and don’t mind the humiliation of owning a crummy NBA franchise in a small market where there’s no expectation or pressure to win, then sit tight. The value will only increase, along with the headaches.

Here’s the curious thing about owning the Kings. While the team enjoys epic leaps in value, the road to riches is littered with financial setbacks and disappointment for people who own a piece of the action.

The only time the Kings are profitable is when the boss hands over the keys and walks away. Until the day you sell your team, NBA ownership is a brutal business.

Consider history. In 1983, when several Sacramento land speculators bought the Kings from Kansas City investors, the price was $4.5 million in cash, $4.5 million in deferred payments and $1.5 million to leave Missouri.

Even at those prices, the new Sacramento owners soon squabbled over money. Team credit cards were maxed out and canceled. On paydays, Kings players and staff rushed to their banks, worried the checks would bounce.

In 1992, the exhausted owners sold 53 percent of the Kings to Los Angeles real estate developers. The Southlanders paid $20 million in cash and assumed $60 million in debt. They got control of the team, arena and land in North Natomas.

Within five years, the L.A. guys were running low on cash and patience. They needed a $73 million loan from the city to stay in Sacramento. By 1998, the L.A. crew was ready to bail.

A Las Vegas casino family bought 24 percent of the Kings for $37.5 million, then doubled its investment in 1999 and soon controlled 53 percent. With a partner named Bob Hernreich, the Maloof family eventually held 65 percent (plus the $73 million city debt). They lost money until the 2002 playoff run.

Which brings us to today. Battered by the Great Recession and forced to dump assets, the Maloofs and Hernreich sold their 65 percent to a Bay Area group for $348 million in 2013. The remaining 35 percent stayed with local owners, Sacramento boldface names such as the Benvenuti family, Dave Lucchetti and John Kehriotis.

The Bay Area investors, led by Mark Mastrov and Vivek Ranadive, offered shares to their pals from tech and manufacturing. Local investors, including Mark Friedman, Phil Oates and Kevin Nagle, bought smaller pieces.

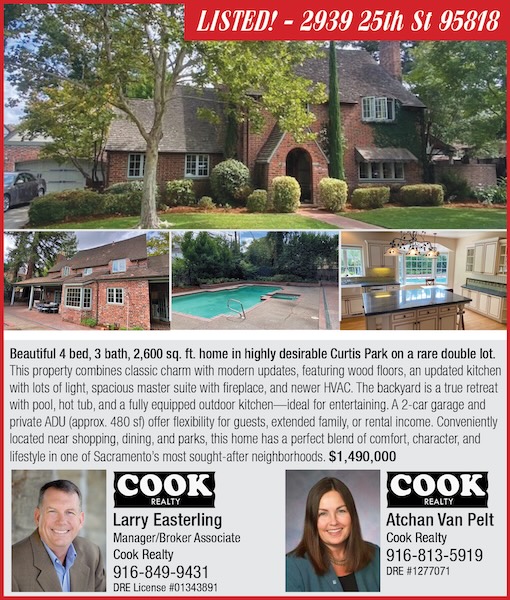

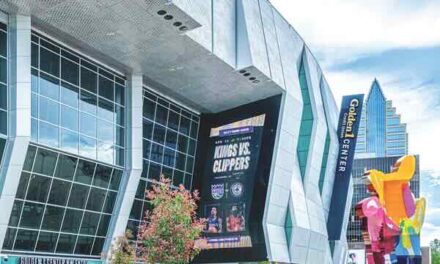

Together they acquired Downtown Plaza and paid off the $73 million city loan. They built Golden 1 Center for $558.2 million (with a $223 million investment from the city). The partners sank $335.2 million into the arena, plus another $300 million or so on Downtown Commons and Kimpton Sawyer Hotel. Those bills add up.

Today, no one person owns controlling interest in the Kings. Ranadive serves as managing partner. He presides over an organization that has been financially devastated by the pandemic—a team with a history of losses on the bottom line and the court.

To stay afloat, the Kings have cut employees, borrowed from an NBA emergency fund and relied on $109 million in league revenue sharing. Ticket and suite sales, concessions and sponsorships have been wiped out.

Want some good news? If you owned 1 percent of a team worth $1.8 billion, you could sell your piece for $18 million, right? Wrong. Minority shares are notoriously hard to price or sell. Fellow owners have first rights to your stock. The NBA must approve all transactions. Shares can’t be used as loan equity or collateral. Minority stock value is extraordinarily limited.

Looking ahead, if controlling interest in the Kings comes up for sale, no one should be surprised.

R.E. Graswich can be reached at regraswich@icloud.com. Follow us on Facebook, Twitter and Instagram: @insidesacramento.